June 26, 2025

Depositary system in Uzbekistan: what has been changed?

Content:

- Structure of Relationships within the Depository System

- Central Depository

- Account-Keeping Institutions

- Depositors

- Depository Agreement

- Interaction between the Central Depository (CD) and Account-Keeping Institutions (AKIs) with Depositors

- Maintenance of Depository Accounting

- Depository Accounts

8.1. Passive Analytical Accounts

8.2. Active Analytical Accounts - Depository Account Operator

- Depository Operations

10.1. Administrative Operations

10.2. Accounting operations

10.3. Information Operations and Reporting - Comparative Table of Old and New Regulations

In order to align legislative acts with current laws and ensure their adoption, the National Agency of the Perspective Projects of the Republic of Uzbekistan (NAPP) has approved a new departmental regulatory legal act.

Specifically, by order of the Director of the NAPP, the “Rules of Maintaining Records of Depository Operations” (Ministry of Justice reg. No. 3628 dated June 16, 2025) have been approved. This document will enter into force on July 1, 2025.

In accordance with the new Rules for Maintaining Records of Depository Operations (hereinafter – the Rules), the following subjects have been introduced:

- Foreign Nominee Holders;

- Custodian Banks that are participants in the capital market.

This memorandum outlines the new legal relationships involving foreign elements and provides a comparative analysis of the regulatory framework that existed prior to the adoption of this act.

1. Structure of Legal Relationships within the Depository System

The authorized regulatory body for securities within the depository system is the National Agency of the Perspective Projects of the Republic of Uzbekistan (NAPP).

The main subjects of legal relationships in the depository system are:

- The Central Depository

- Account-Keeping Institutions

- Depositors

In accordance with the new Rules for Maintaining Records of Depository Operations (the Rules), the following definitions apply to these subjects:

Central Depository (JSC “Central Securities Depository”) – an organization that ensures a unified system for the safekeeping of securities in depository accounts, the recording of rights to such securities, and the tracking of their movement.

Account-Keeping Institution – a legal entity authorized under the legislation to carry out depository operations on behalf of its clients or in their name, as well as to maintain records of securities and transfer rights to them.

Depositor – a person who holds a depository account.

In addition, amendments have been introduced into the depository system with regard to nominee holders.

Nominee Holder – a legal entity (such as an investment intermediary, central depository, broker, custodian bank, etc., including foreign legal entities) authorized to maintain records of securities, certify and transfer rights to them on behalf of the owner or their representative, without itself being the owner of the securities.

Notably, custodian banks and foreign legal entities are now included among the officially recognized Nominee Holders.

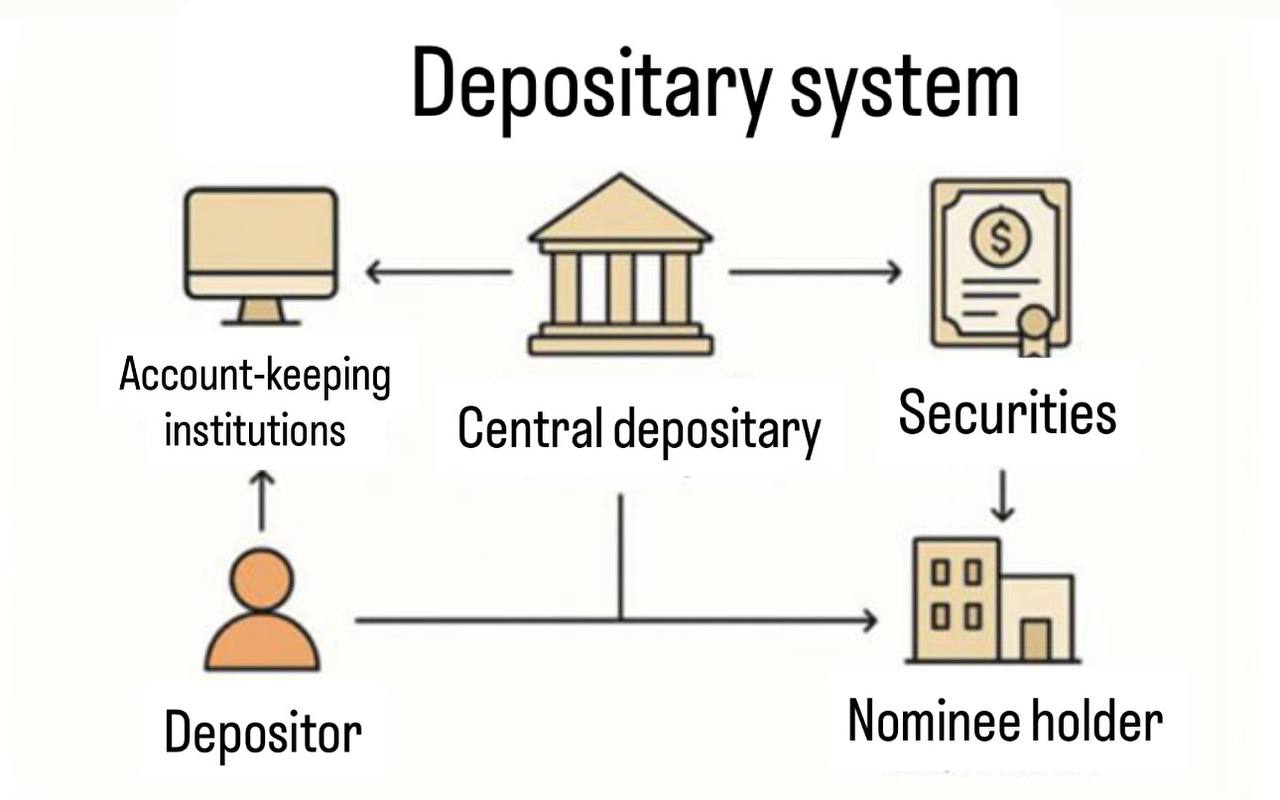

The interaction between the Central Depository, Account-Keeping Institutions, Depositors, and Nominee Holders is illustrated in the following diagram:

2. The Central Depository

According to the new Rules for Maintaining Records of Depository Operations, the Central Depository performs the following functions:

- Safekeeping of securities;

- Maintaining records of the quantity and nominal value of securities held by each depositor with a depository account at the Central Depository;

- Confirming ownership rights to securities based on statements from depository accountsб and other related functions.

In addition, the Central Depository may provide the following services:

- Clearing operations;

- Maintaining cash accounts related to clients’ securities transactions and income received therefrom;

- Including a nominee holder, including a foreign one, in the register of securities holders whose assets are held in the Central Depository;

- Representing the interests of the securities owner at general shareholders’ meetings and voting on their behalf;

- Compiling lists and registers of securities holders when acting as a nominee holder;

- Blocking (immobilizing) securities.

It is important to note that, in accordance with paragraph 17 of the Rules, only the Central Depository is authorized to carry out the safekeeping and immobilization (blocking) of securities.

3. Account-Keeping Institutions

Under the new Rules, Account-Keeping Institutions perform the following functions:

- Maintaining records of the quantity and nominal value of securities and cash belonging to each client, and executing securities transactions and operations in accordance with the agreement concluded with the depositor;

- Internal recordkeeping of securities transactions, as well as organizing and carrying out internal control procedures;

- Confirming ownership rights and other proprietary rights of the depositor based on statements from their depository account;

- Compiling lists and registers of securities holders and custodians, when acting in the capacity of a nominee holder, among other functions.

In addition to the above-listed functions, Account-Keeping Institutions are required to submit client information to the Central Depository for the purpose of forming the register of securities holders. Thus, Account-Keeping Institutions serve as an intermediary link between the Central Depository and the Depositor, facilitating communication and coordination between them.

4. Depositors

Legal entities and individuals that have entered into a depository account agreement with the Central Depository and maintain such an account are recognized as Depositors.

One of the key innovations introduced by the new Rules is the inclusion of foreign persons as eligible depositors. According to paragraph 21 of the new Rules, owners (holders) of securities, issuers, nominee holders (including foreign entities) and individuals, both residents and non-residents of the Republic of Uzbekistan may act as depositors of the Central Depository. Previously, foreign persons were not permitted to act as depositors of the Central Depository.

5. Depository Agreement

According to paragraph 23 of the new Rules, the legal relationships between a Depositor and the Central Depository or an Account-Keeping Institution, concerning the safekeeping of securities and/or the recording of rights to such securities, as well as the provision of other related services, are governed by a Depository Agreement.

Depositor Central Depository (Depository Agreement)

Depositor Account-Keeping Institution (Depository Agreement)

Depending on the specific legal relationship, a depositor may enter into a Depository Agreement either with the Central Depository or with an Account-Keeping Institution.

In accordance with the new Rules, the following types of depository agreements are provided for:

| № | Type of Agreement | Who Concludes | With Whom | Purpose | Legal Basis |

| 1 | Standard Depository Agreement | Depositor (individual/legal entity) | With an Account-Keeping Institution (broker, bank, etc.) | When the securities owner operates through an account-keeping institution | clause 23, 24 |

| 2 | Issuance Depository Account Agreement | Issuer of securities | With the Central Depository | For accounting of issued securities before distribution to investors | clause 25 |

| 3 | Agreement with a Trust Manager | Entity managing third-party securities (bank, AMC, etc.) | With an Account-Keeping Institution or Central Depository | When securities are transferred into trust management | clause 26 |

| 4 | Agreement with a Nominee Holder (Correspondent Relationship Agreement) |

Nominee holder (broker, custodian bank) | With the Central Depository | For opening accounts on behalf of third parties (clients) | clause 27 |

| 5 | Agreement with a Foreign Nominee Holder (Correspondent Relationship Agreement) |

Foreign custodian bank or clearing company | With the Central Depository | For accounting of foreign investors (omnibus account / direct individual account) | clause 27, 44–45 |

| 6 | Adhesion Contract | Any Depositor | With an Account-Keeping Institution or Central Depository | Adhering to standard terms (e.g., online agreements) | clause 42 |

Alongside the depository agreement concluded with foreign nominee holders, the following types of accounts were introduced:

– Foreign Nominee Account;

– Omnibus Account;

– Direct Individual Account.

A Foreign Nominee Account is a type of depository account opened by a foreign nominee holder in the Central Depository, either directly in the name of a single foreign beneficial owner (individual account) or in the form of omnibus accounts.

An Omnibus Account is a nominee account opened by a nominee holder in the Central Depository in which the total quantity and value of securities belonging to all foreign beneficial owners and/or foreign nominee holders are recorded collectively.

A Direct Individual Account is a depository account opened by a foreign nominee holder in the Central Depository directly in the name and on behalf of the foreign beneficial owner.

The introduction of these new account types—foreign nominee account, omnibus account, and direct individual account—has brought the existing depository system of the Republic of Uzbekistan significantly closer to international standards, including IOSCO guidelines and the practices of developed markets.

Whereas the previous system was primarily focused on the domestic market and interaction among local participants, the updated system integrates a comprehensive foreign component. This enables:

• Foreign banks, custodians, and clearing institutions to act as nominee holders;

• Recognition of the interests of foreign investors and their beneficial clients;

• Flexibility in recordkeeping formats—both aggregated (omnibus) and named (individual accounts).

6. Interaction between the Central Depository and Account-Keeping Institutions with Depositors

According to paragraph 28 of the new Rules, the Central Depository and Account-Keeping Institutions are obligated to carry out depository operations with a depositor’s securities based on their written (or electronic) instructions or documents serving as the legal basis for such operations.

The form and content of such instructions are now determined by the internal regulations of the Central Depository and the respective Account-Keeping Institution.

The Central Depository and Account-Keeping Institutions are required to provide depositors with reports and notifications in accordance with these Rules.

In the event of discrepancies between the data held by the Central Depository or the Account-Keeping Institution and that of the depositor, the depositor must submit a discrepancy notice along with documents supporting the accuracy of their information. Upon review, a discrepancy resolution act is drawn up. If the rights of securities holders are not violated, corrective entries are made based on the act.

7. Maintenance of Depository Accounting

A significant development is the adoption of the double-entry accounting principle as the standard method of recordkeeping.

Paragraph 34 of the Rules:

- Securities must be recorded in depository accounts using the double-entry method: each security must be simultaneously recorded on a passive and an active analytical account;

- A securities balance must be maintained: the total number of securities of the same type recorded on passive accounts must equal the total number on active accounts.

Paragraph 35 of the Rules:

- The emergence of a negative balance of securities after the close of the operational day is not permitted;

- Depositors must not be prevented from transferring securities to a depository account opened with another participant in the depository system, including through the imposition of fees.

The executives of the Central Depository and Account-Keeping Institutions are responsible for organizing internal accounting systems.

8. Depository Accounts

8.1. Passive Analytical Accounts

Each depositor is assigned a separate depository account in the Central Depository or an Account-Keeping Institution for recording securities held by them.

Depository institutions may open various types of accounts for:

– Securities owned directly;

– Securities held in trust or under other contractual arrangements;

– New, redeemed, or canceled securities issues.

Types of passive analytical accounts include:

- Owner’s Account – for recording securities owned by the depositor;

- Issuance Depository Account – for recording securities issued, redeemed, or canceled by the issuer;

- Transit Issuance Account – for placement, redemption, or repurchase of securities by an investment intermediary;

- Trustee Account – for securities held in trust management;

- Omnibus Account – a nominee account (including for foreign holders) to record the total holdings of multiple foreign beneficial owners or nominee holders;

- Personal Investment Account – for Uzbek citizens over 18 to account for their securities and funds;

- Nominee Holder Account – opened only in the Central Depository;

- Pledgee Account – for securities pledged under a collateral agreement;

- Demand Account – for securities of depositors who have not entered into an agreement or whose ownership is unidentified;

- Transit Depository Account – for consolidating and distributing client securities and other transactions.

Note: This list is non-exhaustive. The Central Depository and Account-Keeping Institutions may open other types of accounts as permitted by law.

Passive accounts and subaccounts may have the following statuses: active, inactive, blocked, credit-allowed, debit-allowed.

8.2. Active Analytical Accounts

Under paragraph 47 of the Rules, the Central Depository opens active accounts to record securities held in foreign depositories or clearing organizations.

The accounting system must include the following types of active analytical accounts:

– Primary (Domestic) Custody Account – for securities issued under national legislation;

– Account by Place of Custody – for securities held in international depositories, foreign central depositories, or custodian banks.

Statuses of active accounts:

– Active – all operations permitted upon submission of required information/documents;

– Inactive – zero balance; only informational operations allowed; status cannot be changed;

– Blocked – no operations affecting balances allowed except in cases permitted by law or corporate actions; informational and administrative operations (including status change) are allowed.

9. Depository Account Operator

A depositor may manage their depository account independently or appoint an operator to manage it. Once appointed, the operator assumes full authority over the account, except for cases otherwise specified in the depository agreement.

10. Depository Operations

Depository operations are classified into the following types:

- Administrative operations

- Accounting operations

- Information operations

- Integrated (complex) depository operations

Administrative operations are depository actions that do not result in changes to the balances of depository accounts. These include opening, modifying details, or closing depository records or registries.

Accounting operations are operations that change the balances of securities in depository accounts.

Information operations involve the generation of reports, statements, and certificates on the status of depository accounts or other registries.

Integrated depository operations include a combination of administrative, accounting, and information operations.

10.1. Administrative Operations

Administrative operations include:

– Opening of a depository account;

– Updating account holder details;

– Closing a depository account;

– Opening a sub-account;

– Appointing an operator for a depository account or its sub-account.

To open a depository account, the Central Depository and the Settlement Organization must register both individuals and legal entities in the Unified Depositor Database and assign them a unique code. This registration is conducted in accordance with the Regulation on the Unified Depositor Database in the Depository System of the Republic of Uzbekistan, approved by the Resolution of the Cabinet of Ministers No. 196 dated April 29, 2003.

The legal basis for opening a depository account is a Depository Agreement entered into with the Central Depository or an Account-Keeping Institution.

10.2. Accounting Operations

An operation involving the safekeeping of securities issued in Uzbekistan is considered an inbound accounting operation, recorded as a debit to the active account and a credit to the passive account.

Upon completion, the Central Depository generates a transaction report or provides a statement from the depositor’s depository account.

As a new development, the recording of foreign securities is also classified as an inbound accounting operation and consists of crediting the depositor’s account and debiting the NOSTRO custody account.

Recording of foreign securities occurs when securities are transferred into the Central Depository from a foreign depository.

Write-off of foreign securities is an outbound accounting operation: the depositor’s passive account is debited, and the NOSTRO account is credited. This happens when ownership rights are transferred from the Central Depository to a foreign depository.

10.2.1. Accounting for Securities Issuance

Accounting begins with the opening of an issuance account for the issuer in the Central Depository. Once the issue is officially registered, the total volume of securities is credited to the issuer’s active analytical account. This represents the securities entering circulation. Subsequently, they are debited from that account and distributed to passive accounts of investors (depositors) through primary placement or other mechanisms.

These transactions follow the double-entry principle: from the issuer’s active account to the acquirers’ passive accounts. While these do not affect the depository’s balance sheet, they must be registered in the depository operations journal.

10.2.2. Accounting for Global Operations

Global depository operations involve system-wide adjustments to an entire issuance rather than individual depositor accounts. These include, for example, changes in issuance identifiers (e.g., ISIN, par value), renaming of the issuer, restructuring or consolidation of issuances. Unlike regular client transactions, global operations are initiated by the issuer and executed by the Central Depository without changing client holdings, but with adjustments to the central record of securities characteristics. Such actions require centralized documentation, transparency, and mandatory registration in accounting logs.

10.2.3. Accounting for Stock Splits and Reverse Splits

A split or reverse split (consolidation) modifies the quantity and par value of securities without changing the total asset value. For example, 1 share with a nominal value of 1,000 UZS may be split into 10 shares of 100 UZS each. The Central Depository recalculates all positions across accounts holding the affected securities. The operation is processed simultaneously for all accounts, including those in Account-Keeping Institutions. These are recorded as internal reallocations within the same issuance, with corresponding accounting entries. This corporate action is based on the issuer’s resolution and is recorded in the depository system without altering ownership rights.

10.2.4. Accounting for Bonus Share Allocation (Capitalization)

Capitalization refers to the allocation of additional shares from the issuer’s own funds (e.g., retained earnings or reserves). These shares are typically distributed free of charge, proportionally to existing holdings.

The Central Depository credits the new shares to depositors’ accounts based on the shareholder register provided by the issuer and debits the issuance account accordingly.

These operations do not affect the depository’s balance sheet but are recorded in the operations and accounting registers.

Capitalization increases the number of securities in circulation without changing the investor’s total asset value, but it may impact market liquidity and share prices.

10.2.5. Accounting for Securities Cancellation

Cancellation is the process of permanently removing securities from circulation, rendering them legally void. This may occur due to redemption of bonds upon maturity, buyback and destruction of shares by the issuer, cancellation of erroneously issued securities or court decisions. Accounting-wise, this involves writing off securities from investors’ depository accounts and transferring them to a special cancellation account of the issuer. The securities are then removed from the accounting system.The Central Depository records such actions in its logs. The outstanding volume of securities decreases, which may affect the issuer’s market capitalization.

10.3. Information Operations and Reporting

This section governs how the Central Depository and Account-Keeping Institutions manage client reporting, internal accounting records, and interaction with state authorities and market participants.

Information operations include: providing statements of account to depositors, generating transaction reports, sending corporate action notifications, disclosing information to regulatory bodies, data exchange with issuers and nominee holders. Every such action must be recorded in accounting logs and supported with document copies and electronic logs. Depositories must also comply with confidentiality and data protection requirements and follow the formats and deadlines for reporting as outlined in account cards and depository agreements. This ensures transparency in recordkeeping, protection of investor rights, and compliance with international disclosure standards, especially in the context of foreign market participants.

11. Comparative Table of Old and New Rules

|

Criterion |

Unified Rules (Standards) for Depository Accounting and Reporting” |

Rules for Maintaining Records of Depository Operations” |

| Custody of Securities | Securities were stored both in the depository and in external custodians (banks, etc.). | According to the new rules, securities are now stored exclusively in the Central Depository. [para. 16–17] |

| Securities Accounting | Accounting was based on internal rules, using both synthetic and analytical methods. | Under the new rules, accounting is simplified. Direct double-entry accounting is introduced, and negative balances are prohibited. [para. 34–35] Also introduced: – Omnibus Accounts; – Foreign Securities; – Nominee Holders. [para. 1; 44–45] |

| Basis for Transfer of Securities | Transfers were carried out based on inter-depository instructions. | Transfers are executed based on depositor instructions submitted in written or electronic form. [para. 28–29] |

| Matching of Instructions | Matching involved comparing parameters of two instructions—one for debit and one for credit. | Matching is not explicitly described but integrated into the process of instruction handling and discrepancy resolution. [para. 32] |

| Execution Conditions | Execution was possible only when instruction parameters matched; verification was mandatory. | Verification is confirmed by discrepancy resolution acts if mismatches occur. [para. 32] |

| Exceptions (Unilateral Operations) | Not specifically defined — all operations required instructions. | Unilateral operations are allowed by court decision, state authority, or in case of corporate actions. [para. 28] |

| Execution and Recording | Recorded in registers and balances. | Recorded in the operations log and registers, using double-entry bookkeeping. [para. 13–14; 34] |

| Not regulated. | Procedure for notification and discrepancy resolution act is established; corrections are made accordingly. [para. 32] | |

| Not defined in the old act. | A type of depository account opened by a foreign nominee holder in the Central Depository, either in the name of a foreign beneficial owner (individual account) or in omnibus form. | |

| Not defined in the old act. | A nominee account opened in the Central Depository, where the total quantity and value of securities held by all foreign beneficial owners and/or nominee holders (including foreign) are accounted collectively. | |

| Not defined in the old act. | A depository account opened by a foreign nominee holder directly in the name and on behalf of a foreign beneficial owner. | |

| Not defined in the old act. | An individual depository account of a nominee holder’s client. |