April 29, 2022

New opportunities for the development of the private sector in Uzbekistan

The President of the Republic of Uzbekistan signed the Decree No. UP-101 dated 08.04.2022″On the next reforms to create conditions for stable economic growth by improving the business environment and the development of the private sector” (hereinafter referred to as “the Decree”). The main novelties of this Decree are described below.

Benefits of the acquisition of state assets

The Decree defines that in order to accelerate the privatization process and create convenience for investors who have acquired state assets (state shares, package of shares, real estate):

- to apply the payment procedure in installments of up to 3 (three) years that applied to the sale of state assets and to the process of sale of non-agricultural land plots on the basis of ownership through an auction;

- to grant the right to pledge these state assets and land plots as credit collateral to buyers of state assets and non-agricultural land plots sold on the condition of payment in installments, who have made an initial payment in the amount of at least 35 percent at a time.

Acquisition of real estate

The Decree also notes that from May 1, 2022, foreign citizens are granted the right to make investments in the form of acquiring the following new real estate objects under construction (with the exception of land plots), the list of which is approved by the Cabinet of Ministers, without requesting a residence permit in the Republic of Uzbekistan:

- in the Tashkent region, the cities of Tashkent and Samarkand — real estate objects, the value of which, in accordance with contracts concluded during the construction period, is at least the equivalent of 150,000 US dollars, real estate objects taken into operation, worth at least the equivalent of 180,000 US dollars;

- in other regions — real estate objects, the value of which, in accordance with contracts concluded during the construction period, is at least the equivalent of 70,000 US dollars, real estate objects taken into operation, worth at least the equivalent of 85,000 US dollars.

It should be noted that above mentioned purchases of real estate will not be the basis for obtaining permanent registration and residence permit in the Republic of Uzbekistan.

Also, the amount of the value of real estate is reduced from 400 thousand US dollars to 300 thousand US dollars in the city of Tashkent and the Tashkent region, which was required for obtaining a residence permit in the Republic of Uzbekistan by foreign citizens. This reduction in the amount is applied if the acquisition of immovable property complies with the conditions of Annex No. 6 to the Decree of the President of the Republic of Uzbekistan No. UP-5611 dated January 5, 2019, which provides a list of countries whose citizens have the right to obtain a residence permit in the Republic of Uzbekistan subject to the acquisition of immovable property.

Changes in the sphere of tax and customs benefits

According to the Decree, the personal income tax rate (except for dividends, interest and income from freight) for non-residents will be reduced to 12% from May 1 this year. The current tax rate is 20%. For dividends and interest – 10 % and for income from freight – 6 %.

The Decree establishes a new procedure for granting customs duty exemptions, which will come into force on July 1, 2022. According to the new procedure, customs duty exemptions are granted only by the laws of the RUz. In this case, it will be necessary to obtain the conclusion of the Council for tariff and non-tariff regulation. Furthermore, the heads of the branch ministries and departments, local public authorities submit reports on the effectiveness of special tax and customs benefits for the development of the industry and (or) territory to the Ministry of Finance and the State Tax Committee before March 1 every year.

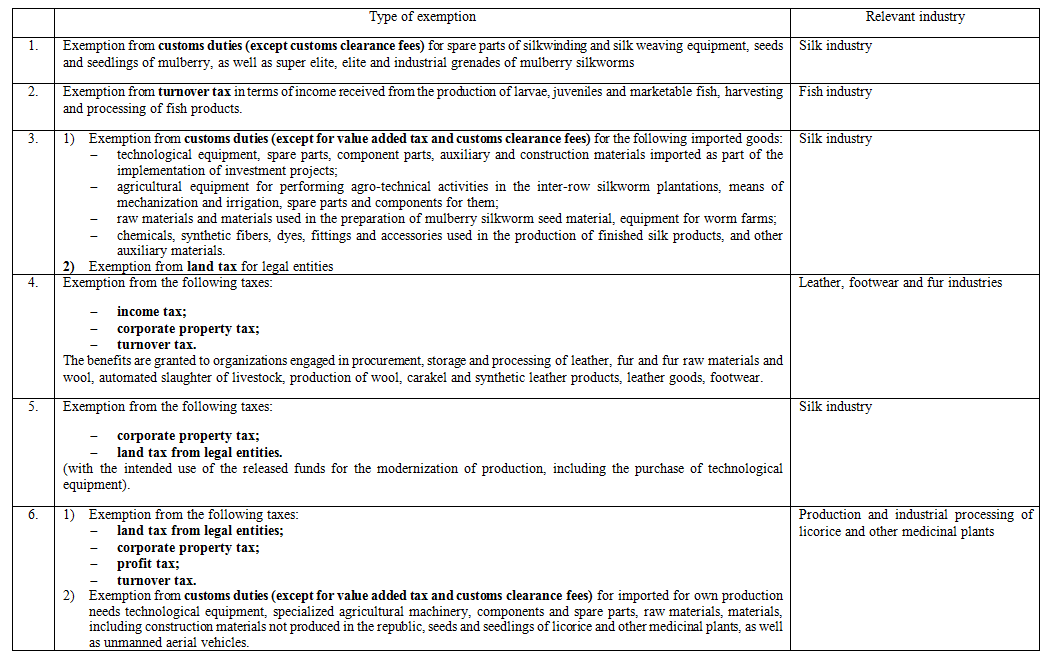

In order to create a level playing field for business entities, the following tax and customs exemptions applied to certain entities now apply to all entities in the relevant industry starting from May 1 of this year:

As per the Decree, a number of customs and tax exemptions are also cancelled according to the approved schedule.

Further privatization of state assets

The Ministry of Finance, together with a number of other state bodies, plans to:

- begin work on the privatization of “Uzbekneftegaz” JSC (including through a public offering (IPO) of shares in the amount of at least 49%) and state shares in “Thermal Power Plants” JSC in the amount of 51% or more with the involvement an experienced investment bank by the end of 2022;

- develop a strategy for reforming “Uzbekhydroenergo” JSC based on the conclusions of an international consulting company by September 1, 2022. At the same time, in the process of construction of new hydroelectric power plants (small and medium), priority will be given to projects with the participation of the private sector (including those based on PPP conditions);

- start work on putting up for auction state shares in the amount of 51% or more in the authorized capital of “Uzbekistan Airways” JSC (including through an IPO) by September 1, 2022;

- provide an IPO of up to 10% shares in “UzAuto Motors” JSC with the involvement of an international investment bank and consultants by August 1, 2022. In addition, it is planned to develop a strategy for the sale to strategic investors of the remaining share of “UzAuto Motors” JSC, as well as JSC “UzAuto Motors Powertrain” and “Samarqand Avtomobil zavodi” LLC.

The Cabinet of Ministers within 2 months period to ensure:

- obtaining an international credit rating for the “National Electric Grids of Uzbekistan” JSC by the end of 2023, and “Uztransgaz” JSC by the end of 2024;

- improvement of the activities of “Khududgaztaminot” JSC and “Regional Electric Networks” JSC based on the conclusions of international financial institutions and consultants by September 1, 2022. At the same time, the issue of transferring the functions of wholesale purchase and sale of natural gas and electric energy to a private operator will be resolved.

It is also planned to develop:

- a strategy for the transformation, development and privatization of “Uzbekistan Temir Yollari” JSC with the assistance of the World Bank by June 1, 2022;

- proposals for involving the private sector in the operation of public transport (based on the terms of PPP) by August 1, 2022;

- strategies for reforming “Uzbektelecom” JSC and “Uzbekiston pochtasi” JSC by September 1, 2022;

- a draft resolution providing for the transfer of international airports under “Uzbekistan Airports” JSC to the management by the private sector (based on the terms of PPP) within 2 months;

- a draft resolution on reforming the Committee of highways within 2 months.

Changes in antimonopoly legislation

In order to improve the competitive environment, the Decree introduced a number of amendments to the antimonopoly legislation. In particular:

- Now legal entities or individual entrepreneurs, or a group of persons whose revenue from the sale of goods (services) for the last calendar year does not exceed 10’000 BRV (about 240’000 US dollars) are not recognized as occupying a dominant position in the commodity or financial market and, thus, antitrust measures cannot be applied to them.[1]

- From September 1, 2022, financial sanctions will be applied to business entities that have committed the following anti-competitive actions:

- Enter into agreements (coordinated actions) and coordination of economic activities leading to restriction of competition;

- Abuse of a dominant or monopoly position, as well as excellent bargaining power, unjustified overestimation of prices for strategically important products, unfair competition;

- Violate of competition law during mergers, acquisitions, as well as the conclusion of agreements on the acquisition of shares (stakes) in the authorized capital of business entities;

- Commit anti-competitive actions at public auctions and violating antimonopoly requirements.

- From September 1, 2022, administrative liability will expand for the following actions:

- Illegal restriction by state authorities of free movement and sale of raw materials, goods and services;

- Decision-making by organizations and bodies authorized to license, register, accredit and issue permits restricting competition

- Failure to provide the necessary documents and information, as well as the submission of false or unreliable information at the request of the antimonopoly authority.

- Measures will be taken to eliminate existing monopolies by attracting the private sector and abolishing exclusive rights in accordance with the Plan.

- From January 1, 2023, the Competition Development Index will be introduced.

[1] The exceptions are subjects of natural monopolies, participants in public procurement and exchange trading, as well as economic entities whose price of products is regulated by the state.